The Of Kruse Motors

The Of Kruse Motors

Blog Article

The Single Strategy To Use For Kruse Motors

Table of ContentsThe Facts About Kruse Motors RevealedThe smart Trick of Kruse Motors That Nobody is Talking AboutNot known Incorrect Statements About Kruse Motors Unknown Facts About Kruse Motors

The proprietors will certainly have no individual liability for the obligations and responsibilities of the LLC. This contrasts with a collaboration, which does not shield from personal liability either basic companions or restricted partners who take part in management. LLCs may be treated as collaborations for government tax functions (kruse motors marshall minnesota). Therefore, unlike a C corporation, the LLCs income is exempt to dual taxation.

The determination relies on the number of proprietors. If an LLC is formed with a single member, it is an ignored entity. If an LLC has two or more participants, it can elect to be strained as a collaboration or a firm. Internal Profits Code Area 754 Political election Whenever a member's interest in an LLC is transferred by fatality or sale, Internal Profits Code Section 754, handling collaboration taxation, enables a collaboration, or an LLC, to value the underlying assets (inventories, depreciable assets, etc) which are attributable to the inbound participant's interest, at a value equal to the purchase price allocated to the properties if a sale, or reasonable market value if transferred by death.

Kruse Motors - Truths

Result of Election on Customer of a Participant's Passion The buyer of a member's rate of interest in an LLC gets a new basis on the possessions of the LLC which are attributable to the member's interest. If the rate of interest is 80%, the new member will have a stepped-up basis in 80% of the LLC's possessions.

Result of Election on the LLC The LLC will certainly have to track the different basis and devaluation schedules - kruse marshall mn. Some LLC arrangements offer that any type of additional management costs are to be birthed by the member benefiting from the election. Result of Election on the Vendor The vendor still needs to pay a resources gains tax obligation on the gain over the vendor's basis when it come to the interest being sold

Effect of Election on Fatality of a Member If a 754 political election is made upon the transfer of a participant's interest because a participant's fatality, the buyer, or heir of the passion, has the same benefits as are stated over when a participant's rate of interest is marketed. Effect of Election on LIFO Reserve During the previous 3 years, there has actually been a rise in making use of the LIFO inventory method of accountancy by vehicle dealerships.

The proprietor hence faces the earnings tax effects of the LIFO book. Ending the LIFO technique of inventory accounting will normally produce large revenue tax obligations. If the firm's supply is sold, the owner might be compelled to lower the selling price as a result of the LIFO reserve. If the proprietor offers the car dealership's properties, the company will certainly recapture LIFO at the time of sale.

Getting The Kruse Motors To Work

Hence, there would be no LIFO recapture, and a new stock expense basis is established for the brand-new participant equal to that part of the purchase rate assigned to the supply. The following is an instance of the impact of the 754 election on an LLCs annual report - kruse motors marshall minnesota. Bear in mind, this annual report would certainly be legitimate only regarding the brand-new member: Possessions Before Transfer After Transfer Change Money $500 $500 Receivables 1000 1000 Supply @ LIFO 5000 7000 2000 Prepaid 50 50 Fixed Properties Cost 1000 1000 Accm Depreciation 800 0 800 Overall Possessions 6,750 9,550 Accountables & Equity Accounts Payable 200 200 Notes Payable 7,000 7,0000 Built Up Cost 500 500 Long-Term Liab 350 350 Proprietors' Equity (1,300) 1,500 2,800 Overall Responsibilities and Equity 6,750 9,550 The publication worth of the company in the instance will certainly be enhanced by $2,800 without paying earnings tax obligations on the assets whose value has been stepped-up to fair market price, and the customer will certainly acknowledge the complete benefit of the stepped-up worth as a result of a higher depreciation basis

Qualified professional recommendations needs to be sought in this location since these sorts of political elections have several implications that need to be checked out, and they may position the companions in conflicting settings. It should be explained that when it come to existing S and C corporations; there might be disadvantageous tax results if these entities are transformed to an LLC.

Some Known Incorrect Statements About Kruse Motors

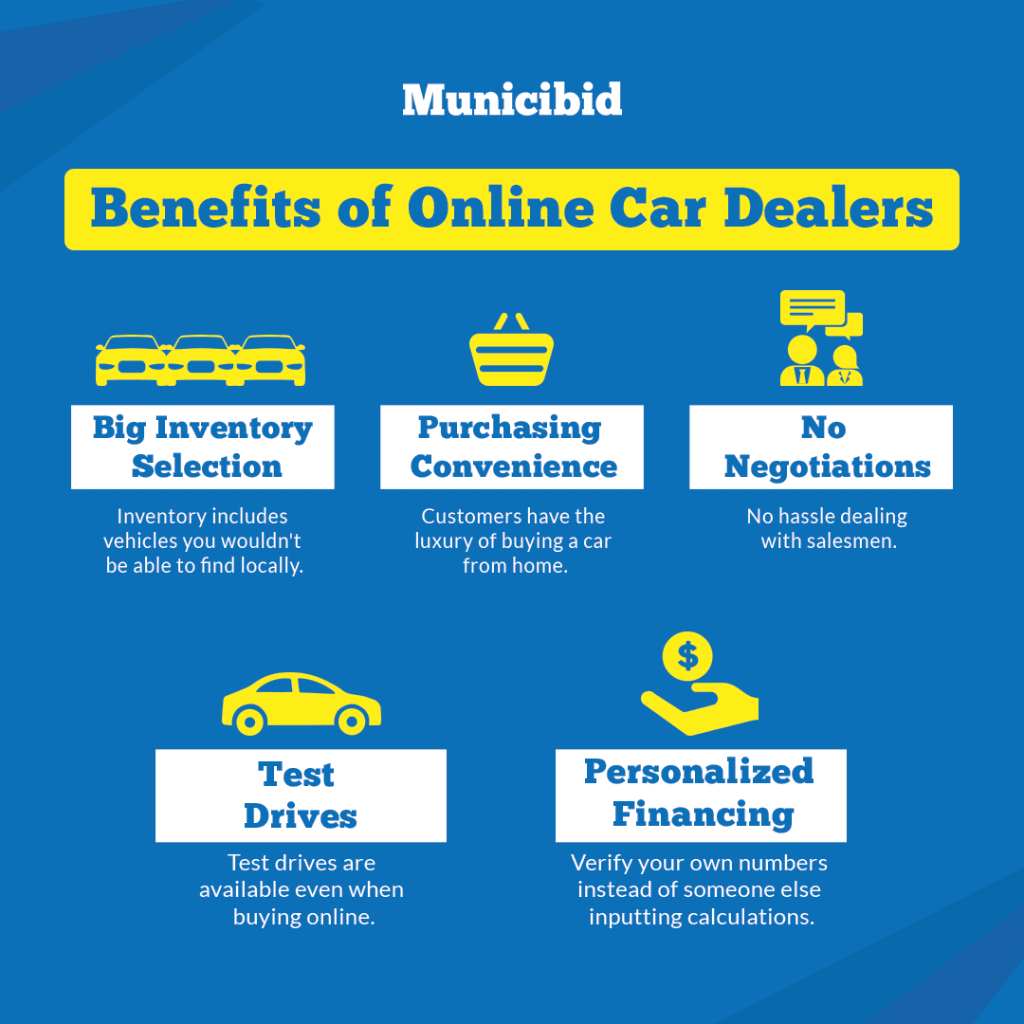

You might reduce time when looking for a used automobile as you may just need to see a couple of automobile dealerships before finding an auto while this procedure might take much longer when taking care of personal sellers. https://disqus.com/by/krusemotors/about/. They can provide you a large option of used cars in one place, from one supplier

Discover the Best Cars And Truck Offers Near You This might come as a shock to you, yet many vehicle suppliers do not really own the autos they're offering. There is usually a number of million bucks well worth of supply on a normal dealership's lot, and those vehicles are all owned by a financial institution or money business.

Report this page